National Insurance is set to increase by 1.25% in April 2022 for both employees and employers to raise funds for the Health and Social care sector. This will mean that businesses and employees will have to pay more in contributions despite already being squeezed by unprecedented inflation and continued uncertainty of the pandemic.

Cost for employees

The rate of National Insurance will increase for employees by 1.25%, due to the new threshold this could have a potential positive impact on employee wellbeing. Combined with a freeze on tax free income thresholds, rising energy costs and unprecedented inflation, the positives might however not be able to outshine the negatives of the current climate. Employees may rely on employers increasing their wages to make up for the rising costs, but this of course is not guaranteed.

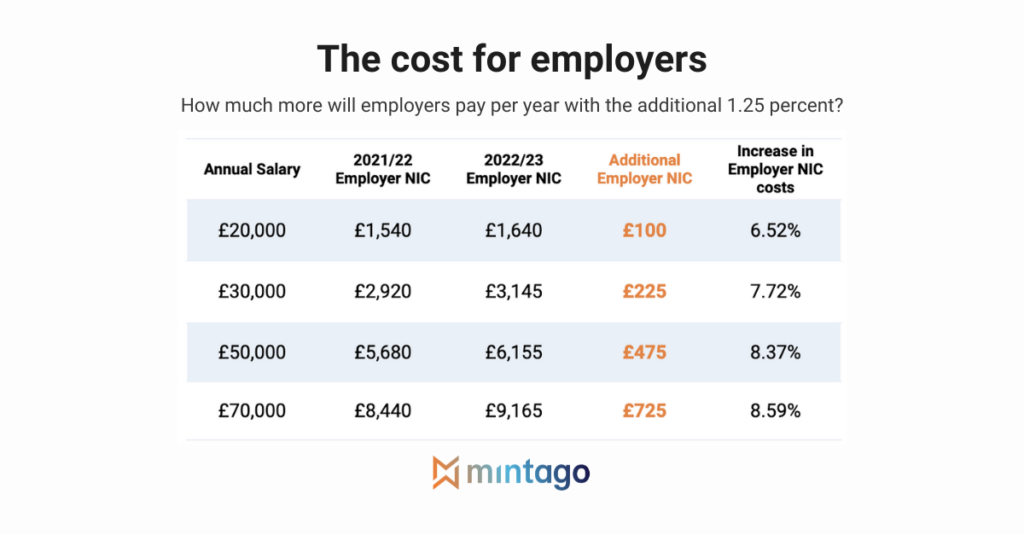

Cost for employers

Although the rate of increase in National Insurance for employees is 1.25%, the rate actually includes employers as well. Depending on the wages that are paid, the increase in National Insurance rate could cost employers as much as an additional 8.6%. Employers will have to pay an additional £225 in National Insurance costs for an employee with an average salary of £30,000. A business with 30 employees with an average salary of £30,000 will have to pay at least an extra £6,750 per year in National Insurance contributions from April 2022.

What you can do

It is vital that businesses act now to give employers and employees the best chance of dealing with the National Insurance increase effectively. Employers can increase employee wages where possible to counteract the increase in National Insurance payments, or implement the Salary Sacrifice pension scheme to reduce National Insurance costs for both employer and employee.