Pensions for employees in their early 20s can not only be overwhelming, but are also unappealing to most. They know they should be doing more to prepare for retirement, but it is not necessarily the biggest priority at the time-being.

There’s a reason most young adults are auto-enroled in a workplace pension scheme. The government knows that setting up contributions automatically will prevent young workers from acting too late. However, the difficult news is just because one is now saving automatically for retirement, it doesn’t necessarily mean they are saving enough.

Here’s the good news: the odds are in their favour

The best part about your younger employees is that they have time. Time is a powerful investment friend that enables you to get a jumpstart on amassing wealth in this decade, and then preserving that wealth as you get older. Given younger workers have a while before they can access that money (the current age to start withdrawing pension starts from 55), they can afford to take risks with their investment because they’ll have more time to recover from losses. We talk on and on here at Mintago about the power of compounding, but it’s only because it really works.

If as an employer you are giving access to a pension that you are contributing and matching to as well, then unless it will directly affect their living potential or their priority is on dealing with unmanageable debt, opting out or only adding the bare minimum to the pot would be like turning down an offer for a pay rise.

Help them have a rough idea about retirement

Imagine on their 50th birthday, they take a peek at their pension pot and realise there might not be enough in there to tide them over retirement. Before they spiral into a mid-life crisis, there are ways you can help that shortfall. At that point, they’ll either have to save harder or save longer, or most likely, both.

Delaying their pension by 5 or 10 years can mean having to double their contributions or postpone their retirement age to make up for the time deficit and getting the same pension income.

There are two main ways you can help employees look at the target goal for retirement.

The first would be to help them track backwards – what size pot do they want to see at the end of their working life? How much income might they need to sustain their preferred lifestyle? The second would be looking at it based on what percentage of their current salary they’re willing to put away. Crucially this figure also takes into account them receiving the state pension, to gain access to which one needs to make 35 years worth of National Insurance Contributions.

At this stage, it’s really just important to support your younger workers in getting a rough plan together, rather than no plan at all.

Salary Curve, Inflation, and other factors

Another great thing about employees in their twenties is that, simply put, their income will most-likely increase through their career progression. When young, committing £400 to a pension fund might seem like a significant portion of salary. However, it’s likely that the same £400 won’t be such a big deal a few years down the road.

This salary curve is important in keeping regular contributions aligned with the pace of inflation. Though pensions usually grow faster than inflation, its value can still be eroded over time and can impact what one chooses to do with their retirement savings. For example, if a pension grew in value by 4% but the rate of inflation that year was 2%, they’re actually earning interest on 2% more. While the prospect of entrusting ones pension pot to the stock market may seem intimidating, one’s given a helping hand in that money is usually deposited in what is known as a default fund, with professional trustees in charge of running pension funds. Starting early also means they have time to add complementary funds to that default option, diversifying, and see how they perform.

State Pensions, that is the standard payment from the government based on the amount of qualifying years of National Insurance payments, is a source of inflation-proof retirement income.

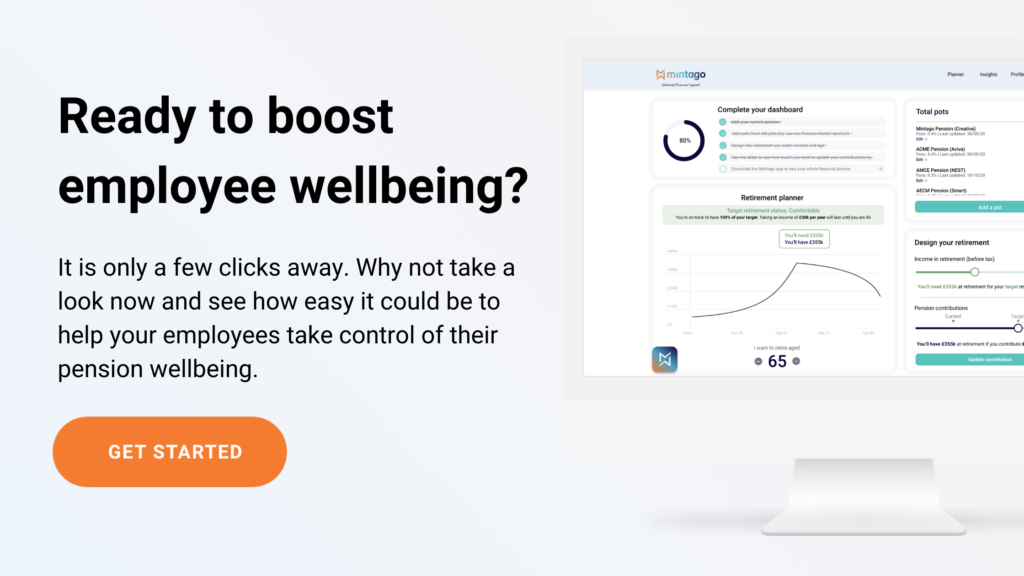

Support your younger workers

94% of millennials aren’t saving enough for their pensions. The good news is that there are plenty of ways employers can help their younger workers take care of their financial future. One is by starting to communicate with them about the risks of not saving enough towards their pension and starting an open conversation. However, an open-door policy might not be enough and it is vital employers start providing employees with the tools and education they need to learn more about pensions. Education is knowledge and it will empower your staff to take control of their financial health. Mintago helps your employees plan and save more efficiently, through the pension dashboard, which enables your employees to find lost pension pots, design their dream retirement and update their contributions. We believe everyone can and should achieve financial freedom.