Pension awareness is vital for your business and your employees. Statistics show that 6.3 million employees are still not paying into a workplace pension. This means that they are not making the most of matched employer pension contributions and are therefore not optimising their pension. If as an employer you are not ensuring that your employees pension wellbeing is taken care of, staff will suffer. This will result in financial stress and an increase in sick days taken due to poor mental health.

Research from Fidelity International shows that nearly a third of pension savers have had to delay their retirement. This delay is due to the pandemic and its financial implications. This highlights why pension awareness is more important than ever. As an employer, educating your employees on how to plan for their retirement is an investment in the success of your business.

Pension wellbeing awareness

On this pension awareness day, we want to help educate employers on how to support their employees. This means helping them take the first steps towards pension awareness and wellbeing. All while also highlighting how Mintago can help support throughout this journey.

According to research, 35% of people (18.4 million Brits), either have no pension at all or are unaware that they have one. This is worrying for several reasons. Employees who do not have a pension or are not contributing enough, are not likely to be able to retire at their desired age. Instead they will be continuously affected by the burden of financial stress. Those who are unaware of how much they should be contributing to achieve their goals may discover later on in life that they do not have enough time left to save. They are likely to face the scary truth of not being able to afford the retirement lifestyle of their dreams.

Support your employees’ pension wellbeing

The younger your employees are when they become pension aware, the better for both them and your business. It is suggested that an individual should take the age that they start paying into their pension, half this and then contribute this amount every month for the rest of their working life. Therefore, an employee who is pension aware and begins contributing to their retirement at age 20, would only need to be contributing 10% of their total income towards their pension every month. However, an employee who is 40 when starting, is likely to have to contribute 20% to retire comfortably. This will be much more difficult for them to afford. It may see them having to choose between a smaller monthly income and a smaller overall pension pot.

As an employer, you can play a vital role in encouraging your employees to become pension aware. Start communicating with them about the risks of not saving enough towards their pension and starting an open conversation about pensions. In this way, you can help them to feel empowered to make the right choices for their future. By providing your employees with the tools and education they need to learn about pensions and why they are important, you can make sure that you are doing everything you can to take care of their overall well-being. After all, this is your duty as an employer.

How Mintago can support your business and employees

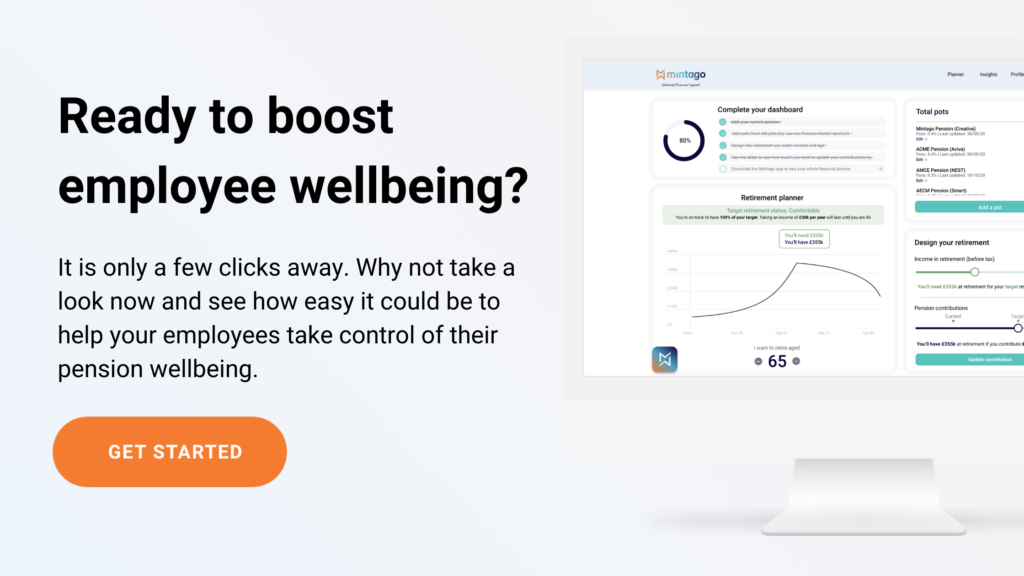

Mintago can help you to support your employees towards better pension awareness and overall wellbeing. Our pension experts are always on hand to answer any questions you might have. Ask anything about pensions and how to get the most from them. Mintago’s pension dashboard provides a visual aid for your employees so that they can see how much they need to be saving towards their retirement to achieve a comfortable one. They can adjust their total contributions to see how much they will have when they retire at a certain age. Knowledge is power! Mintago’s Pension Hunter service helps your employees track down lost pension pots from previous employers, again ensuring that they make the most of their hard earned pension contributions and are in the best position possible when they come to retire.