The April 2022 National Insurance hike will indefinitely have an effect on your business and employees. However, there are ways in which you can prepare to deal with the increase effectively whilst reducing the negative impacts. Salary Sacrifice pension is a great way to reduce the impact of the hike and benefits both employers and employees.

What is Salary Sacrifice pension?

Salary Sacrifice pension is a government-backed scheme that saves employers and employees money on their National Insurance contributions. The scheme can reduce the impact of the National Insurance increase on your business and employees. Employees earn less in gross take-home pay with the difference paid into their pension pot as an employer contribution. Therefore, employees pension contributions are increased whilst their National Insurance contributions are decreased. Over time this results in an increase in overall wages.

Salary Sacrifice pension and the National Insurance increase

Due to National Insurance increasing in April 2022, and the rising costs, employers will have to work harder to maintain employee satisfaction in the workplace. Implementing salary sacrifice pension will reduce employer and employee National Insurance liability. There is no better time to introduce the scheme within your business. With one option being to increase employee wages to counteract the increase and inflation, another option is to introduce salary sacrifice pension to decrease overall National Insurance costs for both parties.

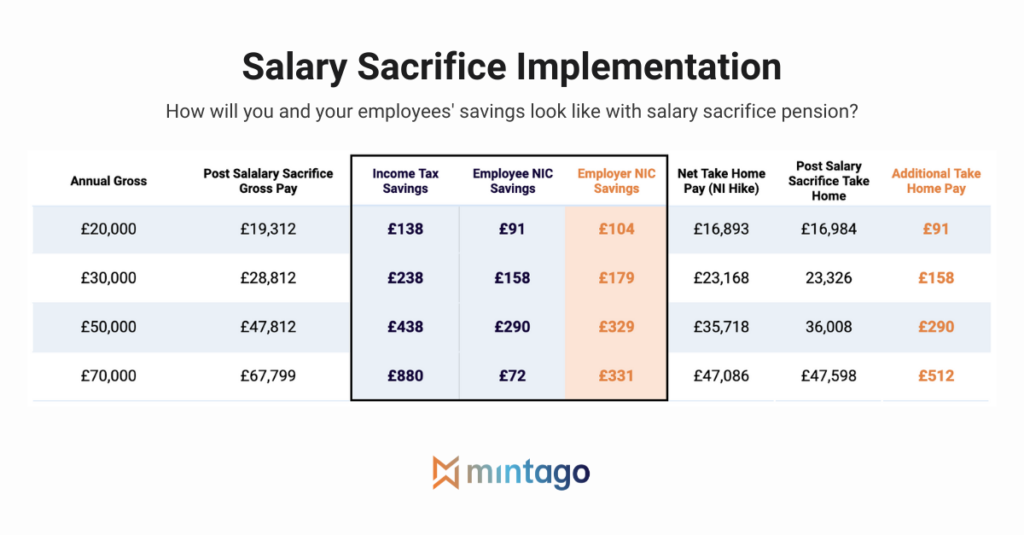

Below is an example of salary sacrifice pension in action:

By taking into consideration an employee with a gross pay of £30,000 post NI hike, their gross salary will be reduced to £28,812 with salary sacrifice pension. The employer will then make NIC savings of £179 for each of their employees based on a £30,000 yearly gross salary.

It is important to consider that although the employee does see a decrease in annual gross salary, the take home pay has actually increased by £158. This is a win-win situation as both the employee and employer will make savings in NIC thanks to the salary sacrifice pension scheme.

How can Salary Sacrifice pension support your business during the National Insurance hike?

Salary Sacrifice pension can support your business by reducing your liability for National Insurance payments. This will allow you to offer a more comprehensive support package to employees due to money being saved.

Employee wellbeing can become more of a priority and benefits such as eating out incentives and childcare vouchers can be introduced. Employees who can save money on leisure activities outside of work are more likely to partake in enjoyable occupations more regularly. This will ensure that they are happy and well-rested when in the workplace, therefore being more productive and putting more effort into their tasks. Your business will thrive as a result of better employee wellbeing. Research shows that 76% of employees believe that their company should be doing more to protect the mental health of their workforce after the pandemic.

Furthermore, salary sacrifice pension will enable you to further support your employee’s pension wellbeing. An increase in employer financial wellbeing support will result in a more healthy pension for employees, ensuring that they are on track to achieve their retirement goals.