The Prime Minister announced that in April 2022, National Insurance rates will increase by 1.25% in order to raise £12 billion towards rebuilding the health and social care sector. This industry was impacted greatly by the Covid 19 pandemic. Despite the reported 1.25% increase for businesses, Mintago has discovered that the actual cost to employers can be a whopping 8.6% on employer NIC. This is astonishing considering the reported headline.

Employers who fight hard to keep their talented employees will now have to fight even harder. The National Insurance increase will mean that employers will either have to face the risk of losing talent and therefore future recruitment costs, or increase employee wages to ensure that they are not hugely impacted by having to pay more National Insurance. Due to the importance of employee wellbeing, employers should consider how best to care for their employees financially and mentally at this time.

The true cost for employers

The true cost of the National Insurance hike, should employers want to keep talented employees and continue to pay them their current take home salary, will vary depending on the employee’s gross pay. Due to the latest NIC threshold changes, employees earning £35,000 or less, will actually receive higher take-home pay. From the total costs calculated, the increase in National Insurance to employers is shown to only take a negative effect for those employees on a gross salary above £35,000.

In order to minimise the effect of the National Insurance increase for businesses and help their employees be better off in a time of rising prices and uncertainty, employers can implement the HMRC salary sacrifice pension scheme. This scheme enables employers to pay their employees less in gross salary, however, contributing more to their pension pot. Despite the gross salary decrease, employees will actually see their take home pay increase, which makes it a win situation for both employer & employees.

Salary Sacrifice Pension

Salary sacrifice pension does not just benefit employers due to National Insurance savings. The money that is saved in National Insurance contributions could be used to improve employee benefits programs within the workplace. Employees who are offered a more comprehensive benefits scheme are likely to be financially better off due to incentives such as the cycle to work scheme. Workplace productivity will increase as a result of employee satisfaction and reduced financial stress.

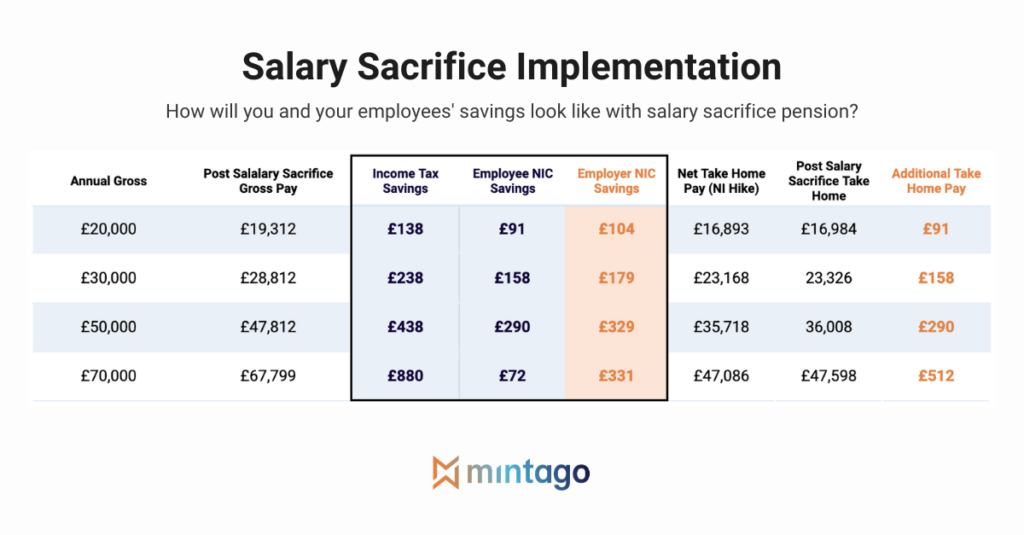

Let’s take a look at what salary sacrifice pension looks like once implemented. By taking into consideration an employee with a gross pay of £30,000 post NI hike, their gross salary will be reduced to £28,812 with salary sacrifice pension. Although the employee does see a decrease in annual gross salary, the take home pay has actually increase by £158. Moreover, both the employer and employee will make savings in NIC thanks to the salary sacrifice pension scheme.

How can Mintago help?

Mintago can help your business to implement this scheme smoothly, supporting you at all stages of the journey including communication, compliance and ongoing management – we do all the heavy lifting.

As an employer, your employees must be supported through the upgrade to salary sacrifice pension. Some employees may be initially concerned due to the technical reduction in their take-home pay. Your office door should always be open for worried employees so that you can answer any questions they may have and point them in the right direction for information to put their minds at ease. It is important to make sure that your employees are well informed about the scheme before its implementation. This is because the more time they have to do their research, the more on board they are likely to be.