Pension Education is a term that not many people are overly familiar with, but a good pension education is a basis for vital life skills that help us become self-sufficient in retirement and confidently take steps towards our hopes and dreams.

Despite the vital life skills that a well-rounded pension education can teach us, there’s a concerning trend that reveals a severe lack of pension literacy across the nation. Research shows that more than a quarter (27%) of people approaching retirement admit that they need help understanding what their income options are when leaving the workplace.

This confirms that in our society there’s a clear lack of confidence when it comes to managing pensions. In fact, according to research, 36% of people don’t have a clue how much money they have in their pension savings.

How did we get here?

The truth of the matter is that if we felt confident enough to manage our own pensions, we wouldn’t be turning to mistrusted institutions for pension contribution guidance. Unfortunately, it comes down to the fact that pension, as well as financial education, is glaringly absent from our school curriculum.

While we are taught mathematics from a young age, being encouraged to understand fractions and Pythagoras’ theorem, there’s a severe lack of education in important pension management skills. Research shows that nearly three-quarters of parents aged over 55 think that children should be taught more about finance, especially pensions, in secondary school.

Unsurprisingly, this lack of education in pension management skills means that when it comes to developing knowledge about pension contribution management, we are ultimately left to learn from the experiences of people that we know. These people might have perhaps failed to contribute enough to their pension, suffering an uncomfortable retirement as a result. This is evident in young adults as many are still developing the skills they need to manage their pension contributions and plan ahead. With little to no guidance, they end up contributing too little to their pension pot to achieve their retirement goals.

Research shows that nearly half (40%) of 18-30-year-olds consider their knowledge of pensions to be poor or very poor. Retirement seems a long way off to this age group, meaning that they tend to focus on financial matters that are more pressing in the short term (ex. mortgage) instead of contributing enough to their pension pot.

What can you do as an employer?

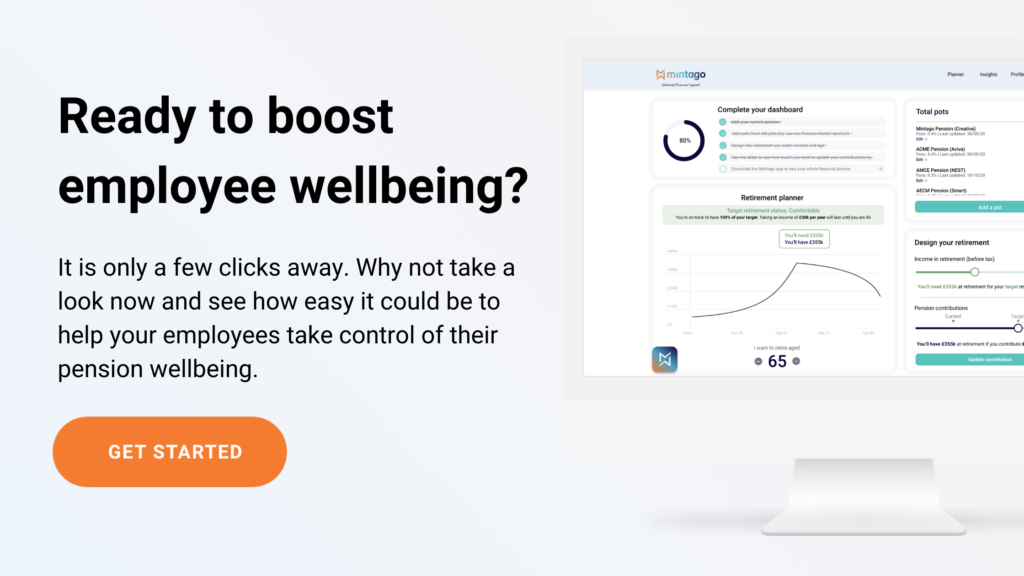

While it’s better to begin to learn these vital pension management skills at a young age, it’s never too late to help your employees take matters into their own hands and go back to basics with their pension education.

The spare time we’ve found ourselves with over the course of the global pandemic may have got people thinking about financial matters in a more critical way. These could entail whether they are prioritising their pension savings or if they should be contributing more. Seeing an overview of all past and present pension pots, planning their dream retirement and understanding how much to contribute to reach their goal are all great ways to gain more pension knowledge. This will help them take their pension education back to basics creating healthier habits going forward. As an employer, the workplace is the best environment to help spur this change.

A promising future

However, the future of pension education is looking brighter. The uncertain state of the economy, paired with an increased demand for pension literacy, may give this conversation the kick start it needs. Currently, pension literacy is not an obligatory subject in schools and may only be covered in passing in financial subjects. Research shows that the top 2 financial topics those aged 18-24 wish that they learnt in school are, what council tax is and how to pay it, and what a pension is and how it will benefit your future.

This demand for pension education isn’t limited to schools. As pension contribution worries seem to become an increasing area of concern across the nation, employers may be motivated to reconsider their attitude towards their employee’s pension wellbeing. Pension education platforms within the workplace are a great way to provide unbiased guidance to employees. They are a great learning tool for adults who are feeling the effects of pension illiteracy after missing out on a comprehensive pension education.